It recently issued warnings of bankruptcy, which likely enticed retail traders even more. The company has fallen significantly over the past year, losing more than 96% of its value.

As noted, it fits the meme stock criteria, at least in part. The company’s recent performance is similar to that of Bed Bath & Beyond (OTCMKTS: BBBYQ), a company that failed almost as badly, if not more.Īfter weeks of struggling, WE stock is finally rising today on interest from meme stock investors. But investors should be careful before jumping into WeWork. Today, WE stock trades at just $0.20 per share, but it has seen a slight resurgence lately as retail investors have taken an interest in the struggling microcap.įlagging a fallen company as their next rescue mission is par for the course for the r/WallStreetBets crowd. But when his reckless actions put the company at risk, he could only stand back and watch as his empire collapsed. Founder and CEO Adam Neumann captured the world’s attention when he introduced the co-working company in 2011, which ultimately received a valuation of $47 billion.

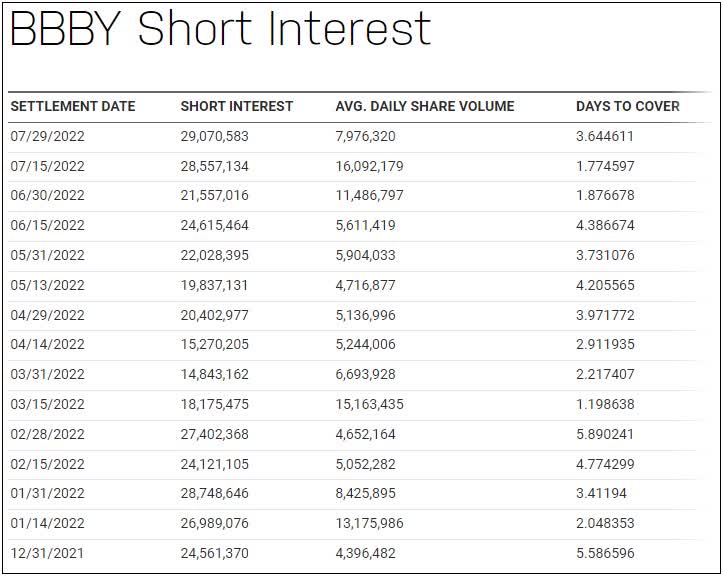

#Bed bath and beyond stock short squeeze series

Now it is the subject of documentaries and a dramatic TV series that tell the story of a company that rose too fast and fell even faster. WeWork (NYSE: WE) made headlines as one of the market’s newest game-changers just a few short years ago. The search for the next meme stock has brought investors to another company that has truly fallen from grace.

0 kommentar(er)

0 kommentar(er)